Digital Label Printing: What's the Sweet Spot?

- Published: September 08, 2010

Much of the information readily available today regarding digital printing for packaging is provided in the context of an “advertorial” or “infomercial,” points out Kevin Karstedt, president of Karstedt Assoc., Eden, NY. “Unfortunately, these advertorials, while typically correct in the picture they are presenting, often provide only a limited view as to the true positioning and capabilities of the technology. This forces the market and prospective buyers to do a lot of digging in order to truly understand the potential opportunity and/or inherent risk associated with the technology.”

Karstedt Assoc. has been helping clients navigate the potential and the pitfalls of the technology for almost a decade. “Our clients have voiced their frustration with the shallow breadth and relevance of information they need to make such critical business decisions around digital printing. I had one customer tell me that most of what they have to go by was either produced or sponsored by the company trying to sell them, 'that's kind of like the fox watching the hen house,'” says Karstedt.

With this need identified, Karstedt Assoc. has introduced a new report series called Commercialization Assessment Reports. The first assessment in the series is geared specifically for the narrow web label printer/converter who is grappling with the decision of whether or not to get into digital printing, and if so, how. The report devotes considerable time walking the reader through a comprehensive view on how Karstedt sees the market developing.

“We believe that although digital will participate in less than 10% of overall market volume, it will have a tremendous impact in the distribution of orders, and the opportunity to create new business opportunities by leveraging a digital offering. We project digital print could be involved in 71% of all job orders,” he says. “In other application areas where digital printing has gained a strong position, suppliers with digital capability have been able to totally transform the traditional process for soliciting, securing, producing, and closing the order. Digital is really about reducing the hassle of getting a finished product, and the entire digital process is ideally suited to that.”

The report goes into great detail identifying what is called the “Digital Sweet Spot,” which is estimated to be just over 1.1 billion MSI, about 8% of the total North American label market of 13.545 billion MSI (see Figure 1). 1.1 billion MSI represents over half of all jobs but only 10% of order volume.

Print Runs Less Than 30,000

The Commercialization Assessment also looks at where the battle will be waged among printers and converters. “The current economics of digital printing really don't support orders beyond 30,000 labels, unless the job requires variable print or has some other compelling value that will justify the price premium,” states Karstedt. “Printers/converters whose primary business is volume runs probably will not see their business greatly impacted by digital printing, unless their customer elects to change ordering patterns that bring the unit quantity per order within a digital range. The printer/converter who will be most impacted is the one who has a high proportion of jobs in runs of less than 30,000 labels.” The assessment spends a good amount of time discussing this “battleground” and how the digital landscape is changing.

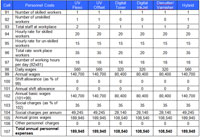

One of the most compelling components for the Commercialization Assessment Report is what the company is calling iVAT, which stands for Investment Validation Assessment Tool. “We recognize that this is not the ideal economy to be taking on a capital investment. We have developed the iVAT as a tool for users to evaluate the many options around digital printing in their company,” says Karstedt. The iVAT is a spreadsheet template that allows the user to model the impact on their business if they were to add a digital press. The iVAT allows the user to enter their own information as it relates to mix, technology utilization, operating costs, etc. (see Figure 2).

They can then pick from a number of alternative digital technologies to see which one provides the best results. “Converters who have seen and used the iVAT have been pleasantly surprised with the flexibility of the tool and how it can give insight into opportunities they may have overlooked.” says Karstedt. “These reports are the collective result of over 20 years of 'roll up your sleeves' work in the field, in-depth discussions with hundreds of converters, brand owners, and systems integrators. Clients have been loudly asking for help, and the Commercialization Assessment Report series is our answer to that cry.

Finally, one important thing the user will notice when they begin reading the report is that it has no reference to any company other than Karstedt Assoc. The company has gone to great lengths to stay independent of any system or technology. “We are technology agnostic in these assessments. Each technology has its inherent strengths and weaknesses, so what is good for one company may not be good for the next. The reports and the iVAT specifically are really geared to help these questions get answered,” Karstedt points out. “There really is a need out there for these types of unbiased tools, and we are pleased to be the ones to deliver them.”

For more information on the Commercialization Assessment Report Series visit www.karstedt.com, contact Kevin at Kevin@karstedt.com, or call 716-992-2017.