What's Next for China?

- Published: January 01, 2007, By By Simon King PCI Films Consulting Ltd.

BOPP Film

The expansion of Chinese biaxially oriented polypropylene (BOPP) film capacity in recent years appears to have been driven by a combination of three factors: increases in domestic demand; absorption of about 200,000 tonnes of imports; and the unrealistic profit expectations of enthusiastic new entrants to the market.

Whatever the reasons, the result is a state-of-the-art and very efficient industry. Many factories are capable of producing at least three-layer films, and a significant number have the capability to produce five-layer coextruded films. Modern, clean, proprietary production units present a highly marketable image of a professional BOPP film industry that appears, on the surface, to have the ability to supply global needs.

International buyers should be clamoring to buy from these suppliers—and to some extent they are. However, the fascinating thing is that while Chinese factories are exporting, they are not exporting at quite the rate many people expected or perhaps wanted.

Export Growth in Context

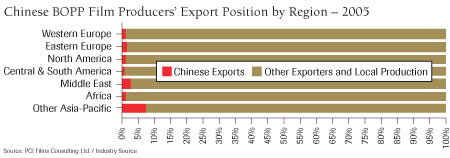

In 2005 less than 10% of Chinese annual BOPP film production was exported and more than 75% of the total was to other countries in the Asia region. According to official trade statistics, the volume of Chinese PP film/sheet exports grew to an annual level of about 184,000 tonnes in the first nine months of 2006, up 25% on the equivalent nine-month period in 2005. But not all of this traded volume is biaxially oriented PP film, as the category also includes cast PP films and some thermoforming PP sheet.

BOPP film exports from China in 2006 are estimated to be 150,000 tonnes, still only equivalent to 10% of Chinese estimated production and the equivalent of a 5% share of the world demand outside of China expected in 2006. In terms of actual volume gained, Chinese film producers have had remarkable successes in expanding their export business from some 30,000 tonnes in 2003 to 150,000 tonnes by 2006. But to put this achievement into context, they really have not penetrated the world market in any significant way (see chart).

Chinese BOPP film producers have not been able in the past—and are unlikely in the future—to gain a significant foothold in world export markets. Why? They don’t need to! There are two reasons for this: Chinese film producers do not work to the same production utilization targets as other world producers; and Chinese domestic market demand is growing so fast that excesses of capacity soon are absorbed.

Different Targets

Compared to other international suppliers of BOPP films, Chinese producers seem prepared to operate at 70%–75% utilization of nameplate capacity and describe themselves as “full,” while most Western companies would see 80%–85% utilization as being more acceptable. So when there has been overcapacity in production in China, as there has been in the past two years, producers are not forced into finding large quantities of export volume to fill production capacity. Indeed most are not ready to do so, even if they have the desire.

Most of the investment in Chinese production lines has been designed to service the Chinese domestic market, which has seen average growth of 14%/yr over the past five years—the equivalent of 120,000 tonnes/yr of additional demand or three to four new 8-m lines. This rate of growth soon absorbs excess capacity in the home market, which otherwise might have been targeted at export markets.

Another factor that has restricted the competitiveness of the Chinese BOPP film industry on the world stage has been commercial policy. While buyers of film from the Asia-Pacific region have been content to purchase standard commodity products from China on the basis of full container loads paid in advance, many large international buyers have found these terms difficult to accept. However, some buyers have been able to do business on more acceptable terms by using middlemen prepared to finance the deal or consolidate shipments. But once commission is added, the cost savings achieved fall well below expectations.

A Competitive World Supplier

Over the next five years, Chinese BOPP film producers are expected to continue making investments in production capacity, using more balanced planning models so significant oversupply is unlikely to occur again. These investments will continue to focus on servicing rapid demand growth in the Chinese home market, but some additional volume will reach those export markets when it suits the company’s strategic goals and when margins allow.

Suppliers of BOPP film outside of the Asia-Pacific region, therefore, should not fear large volume losses to Chinese companies in the short term. Equally, buyers of film should not think Chinese companies need their film purchases to survive. China will remain an important player in the world BOPP film industry with a growing reputation as a competitive world supplier, but it will be some years before leading Chinese producers will be able to offer the film range and commercial terms required to service many of the mature volume markets of the world.

BOPP Film Production in China Fact File

- In 2005 China was home to more than one-third of the world’s capacity to produce BOPP film.

- In 2005 there were at least 77 BOPP film producers, some with more than one operating subsidiary.

- In the period 2000–2005, the Chinese BOPP film industry expanded capacity by 300% to reach an estimated level of 2 million tonnes.

- 60% of the BOPP film capacity installed worldwide in the period 2000–2005 was installed in China.

- Chinese BOPP film demand reached 1.33 million tonnes in 2005, having grown at an average historic rate of at least 14%/yr over the past five years.

- Future Chinese demand is likely to grow at approximately 10%/yr or the equivalent of four new 8-m-wide extrusion lines a year.

Simon King is managing director of PCI Films Consulting Ltd., based in Guilsborough, UK, and has more than 20 years of experience at the senior level in flexible packaging markets. He is the author of a new study, World BOPP Film Market Trends 2006, which provides volume statistics on capacity and consumption for the period 2000–2005 and forecasts to 2010. It also provides profiles of the world’s leading BOPP film producers. PCI produces Quarterly Business Reports and Regional Supply/Demand Reports for the polyester and PP film and flexible packaging markets. Contact King at +44 1604 749001; info@pcifilms.com; pcifilms.com.