Credit Chaos

- Published: January 01, 2009, By By Bill Hornell, Mesirow Financial

What a year 2008 turned out to be. A crisis that began in the subprime lending marketplace escalated into a full-blown credit freeze. Governments across the globe were forced to inject massive amounts of liquidity and capital into the banking system to prevent a complete collapse.

The stock market suffered, economic uncertainties were created, and lenders of all sizes and stripes became much more conservative. Not exactly a great backdrop for merger and acquisition activity!

Global M&A Activity

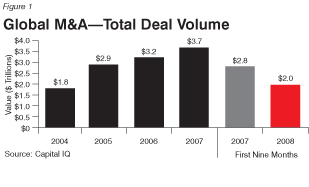

Global merger and acquisition (M&A) activity for the last several years is detailed in Figure 1. This includes a comparison of interim 2007 and 2008 results.

Surely the period of time from 2004 through 2007 will be viewed as one of the best M&A environments of current times. The economy was strong, interest rates were low, and capital was everywhere — both corporate capital and private equity capital. The result was a staggering increase in M&A activity that reshaped numerous industries — banking, pharmaceuticals, aerospace, autos, and of course, packaging.

That all changed in 2008 when the full impact of the credit crisis was felt. Lenders were forced to deleverage their balance sheets rapidly, and acquirers — especially private equity groups — had to move to the sidelines.

The result was that global M&A activity fell by 30% through nine months in 2008. The decline would have been more dramatic if not for some of the shotgun marriages caused by the credit crisis: Bank of America/Merrill Lynch, Wells Fargo/Wachovia, and JP Morgan/Washington Mutual, to name a few.

The game especially changed for the large private equity groups. Names like Blackstone, KKR, Carlyle, and Bain, which had dominated M&A headlines in 2006 and 2007, watched their traditional sources of leverage dry up. Hedge funds, high yield mutual funds, investment banks, and insurance companies, which all had been conduits and sources for turbo-charged debt, saw the capital pools evaporate.

The result was a precipitous drop in large private equity-backed transactions. Most tallies showed a decrease of approximately 80% in 2008 large capitalization private equity transactions. As described later, the impact was not near as great in the middle market, but it was affected as well.

Packaging M&A Activity

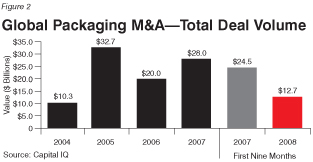

Over the past several years, there have been numerous landscape-changing transactions in all segments of packaging. These include corrugated (IP/Weyerhaeuser), folding cartons (Graphic/Altivity), flexible packaging (Rank Group/Alcoa), labels (Genstar Capital/Fort Dearborn), and rigid containers (Rexam/O-I Plastics).

The industry has been characterized by strategic and financial buyers operating within all major segments. However, as Figure 2 demonstrates, packaging M&A definitely has been affected by the credit crunch.

The bulk of the drop off in 2008 came from a significant reduction in large capitalization transactions. Table I lists packaging transactions in excess of $1 billion in value for the first nine months of 2008 and all of 2007.

It's interesting to note most of the large cap transactions in 2007 involved some element of private equity or leveraged finance. These are obviously the types of transactions missing in 2008.

Middle-Market Activity

Packaging transaction activity remained robust in the middle market. Figure 3 compares total packaging transactions for the first nine months of 2008 with the same period in 2007.

The middle transactions were a nice mix of both strategic and financial buyers. In fact, by Mesirow's count, roughly 50% of the 2008 middle-market transactions were completed by private equity groups.

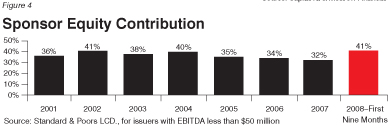

The middle-market private equity groups were able to stay active in 2008 by putting more equity into their transactions. This has allowed groups like Multi-Packaging Solutions Group, Rosmar Litho, Ampac, and Clondalkin to close acquisitions. The increased use of equity in middle-market capital structures is detailed in Figure 4.

Impact on Valuations

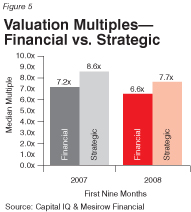

Notwithstanding stable activity in the middle market, the decrease in large cap transactions brought valuation multiples down. The larger deals typically carry higher valuation multiples. Figure 5 compares EBITDA (earnings before interest, taxes, depreciation, and amortization) valuation multiples for strategic and financial packaging transactions during the first nine months of 2007 and 2008.

Uncertain Outlook

Mergers and acquisitions essentially are driven by confidence. If buyers and lenders are unsure about the strength of the economy going forward, M&A volume surely will slide. That having been said, some of the recent high-profile transactions (Rock Tenn/Southern Container and International Paper/Weyerhaeuser) will create significant shareholder value. Acquisitions remain a proven vehicle for supplementing organic growth and enabling cost reductions.

Bill Hornell is a managing director in the Investment Banking Group at Mesirow Financial, Chicago, IL. He has completed more than 60 packaging merger and acquisition transactions. A significant majority of these transactions involved consumer packaging businesses. Contact him at 312-595-6176 or at bhornell@mesirowfinancial.com; www.mesirowfinancial.com.

Table I

Packaging Transactions in Excess of $1 Billion

| Value ($ in Billions) | ||

|---|---|---|

| 2008-First Nine Months | Hicks Acquisition Co./Graham Packaging Holdings Co. | $3.2 |

| Intl. Paper/Weyerhaeuser Co., Containerboard, Packaging & Recycling Business | $6.0 | |

| Full Year 2007 | Rank Investments Group/Alcoa Packaging | $2.7 |

| The Blackstone Group/Klockner Pentaplast GmbH & Co. | $1.8 | |

| Aldabra 2 Acquisition Corp./Boise Cascade Co., Paper & Packaging Assets | $1.6 | |

| Graphic Packaging Corp./Altivity Packaging LLC | $1.7 | |

| Rexam plc/ROSTAR Co. | $1.8 | |

| Pactiv Corp./Prairie Packaging | $1.0 | |

| Bowater Inc./Abitibi-Consolidated Inc. | $4.5 | |

| Brookfield Asset Management Inc./Longview Fibre Co. | $2.1 | |

| The Blackstone Group/Catalent Pharma Solutions Inc. | $3.3 | |

Source: Capital IQ and Mesirow Financial