Mesirow Releases 2016 Mid-Year Packaging Report

- Published: August 15, 2016

CHICAGO, IL | Following a record-breaking year in 2015, the first half of 2016 saw a global cooling-off of merger and acquisition (“M&A”) activity across all industries amid an uncertain deal-making environment, reports Mesirow Financial. The following report is excerpted from the full report, which is available at www.mesirowfinancial.com/investmentbacking.

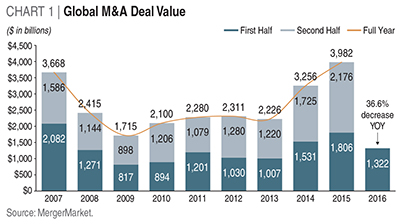

As demonstrated in Chart 1, M&A activity through the first half of 2016 fell 36.6% compared to the same period last year.

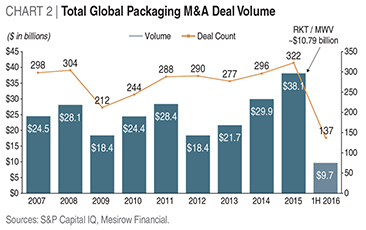

This reduced level of deal activity was mirrored in plastic and packaging sectors, where M&A totals have been suppressed this year due in part to the absence of mega-deals, which boosted deal values in 2015 (see Chart 2).

The recent contraction in global deal activity is not surprising given the ongoing global economic instability and political turmoil. In addition, the failure of several large, high-profile transactions to close has also put a damper on M&A volumes this year. In the first half of 2016, the total value of withdrawn M&A was more than double the level reached in 1H 2015, and the highest since 2007. Rising interest rates may have also lessened corporate confidence this year, leaving some deal-makers hesitant to transact.

All things considered, however, M&A deal activity has remained relatively robust in 2016, as many key drivers of a healthy deal-making environment remain, including favorable lending markets, strong equity markets, significant levels of private equity dry powder and low levels of organic growth.

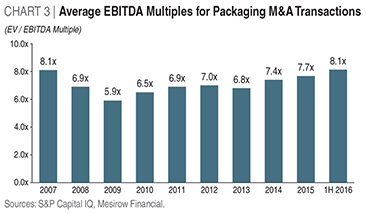

Despite an overall drop in deal volume in 2016, the purchase price for high quality plastics and packaging targets continues to rise in this year, as strategic buyers are forced to pay a premium for growth, and financial buyers scramble to put committed capital to work. In the first half of 2016, plastics and packaging M&A multiples reached the highest levels seen since the 2007 peak (see Chart 3), which may be an indication of strong competition among buyers for the limited number of actionable acquisition targets that remain after years of industry consolidation.

Private equity, private equity-backed strategics and strategic buyers facing internal and external pressure to grow earnings, have all been heavily involved in plastics and packaging M&A activity. In an environment where costs have already been reduced over the last several years and companies are struggling to achieve organic growth, M&A can provide a viable pathway for expansion. Many leading plastics and packaging companies diversified their product portfolios and expanded their sales channels and geographic reach, in many cases through acquisitions.

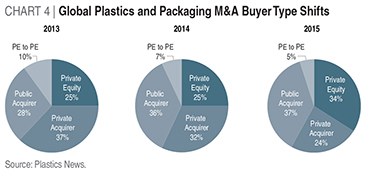

As demonstrated in Chart 4, private equity buyers have also maintained a very healthy interest in plastics and packaging. Over the past several years, private equity firms have accounted for a growing percentage of acquisitions in the plastics and packaging sectors.

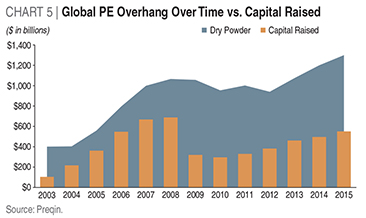

This increase is due in part to private equity firms’ record levels of committed-but-uninvested capital known as ‘dry powder’ that must be deployed, as pension funds, endowments, sovereign wealth funds and other institutional investors increase their allocations to private equity in hopes of above-average returns. See Chart 5 for the growth in available private equity capital since 2003. Pension funds are benefiting from private equity’s superior returns.

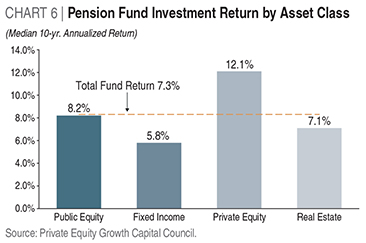

As seen in Chart 6, private equity is the best-performing asset class of pension fund portfolios.

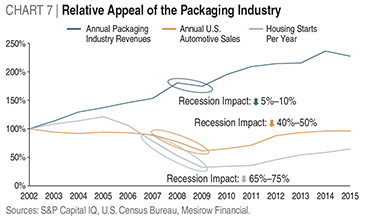

Amid recent market volatility and an increasingly competitive deal-making environment, private equity acquirers may face increased difficulty in achieving appropriate returns in the coming years. Plastics and packaging remain attractive to private equity largely because these sectors are viewed as lower risk and less cyclical than other sectors of the economy (see Chart 7). Given that plastics and packaging are often driven by the food, beverage, healthcare and personal care industries, the cash flows may be more reliable, making them attractive to leveraged private equity capital acquirers.

M&A Outlook

There are compelling reasons to expect plastics and packaging M&A to remain active through the end of 2016. M&A continues to be a viable strategy for plastics and packaging executives as a result of tepid organic growth coupled with a favorable financing environment and historically high valuations. Additionally, many of the plastics subsectors remain fragmented, so it is likely more consolidation will take place. Private equity firms should also remain busy in the packaging and plastics space as they seek to deploy their growing levels of available capital. With both strategic and private equity acquirers on the trail for acquisitions, plastics and packaging M&A activity is likely to maintain a steady pace through the remainder of this year and into 2017.

Spotlight On Corrugated Packaging

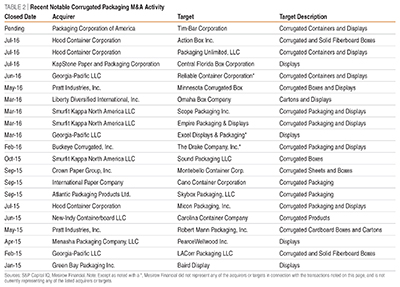

The corrugated industry has been transformed by a number of large M&A transactions, resulting in notable improvement in financial performance. The size and scope of the industry transformation has been quite significant. A few examples are highlighted in Table 2 below.

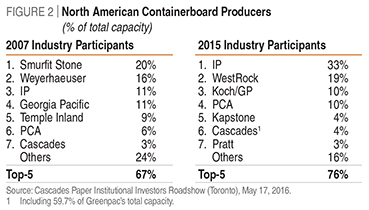

Within North America, the top three players account for 62% of the containerboard market while the top five account for approximately 76% (see Figure 2).

Consolidation in the North American market is expected to continue, absent any regulatory intervention, as flat market conditions force the top industry participants to continue reducing costs in response to the demand of stakeholders for continued increases in profit.