AMI Issues Report on Stand-Up Pouches

- Published: January 03, 2018

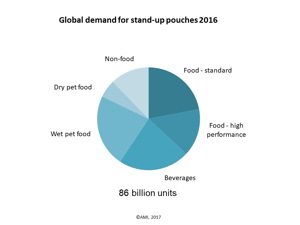

BRISTOL, UK | AMI Consulting has issued a newly published report that says stand-up pouches (SUPs) is now one of the fastest growing flexible packaging formats, with global demand expected to pass 90 billion units in 2017. The study says key drivers of demand will continue to be the favorable development of the total supply chain cost of stand-up pouches and their stronger proposition to promote sustainability compared with rigid packaging.

“Despite the initial high capital investment in stand-up pouch filling lines, the overall savings on packaging costs in tandem with stand-up pouches’ good environmental profile will continue to keep brand owners interested,” says AMI Consulting senior market analyst Márta Babits, adding that the growth of specialty pouch contract packers has also contributed to driving down costs and expanding interest in SUPs.

According to the AMI report, wet pet food in stand-up pouches is long-established and still the largest segment, particularly in developed markets driven by the substitution of cans. The market penetration of beverages has been facilitated by the global market success of Capri Sun, the leading juice drinks brand in stand-up pouches, produced under license by different bottlers across the world and with a continuously expanding production footprint.

Currently the fastest growth can be seen in the high-performance food category, particularly ready-to-eat baby food and fruit compotes driven by glass jar replacement and growing consumer demand for light weight, safe, and convenient packaging for on-the-go consumption. The study says other segments such as liquid yogurts are still niche but are enjoying double digit growth benefiting from new large-scale investments by leading global brand owners.

The market has seen several acquisitions by major flexible packaging converters in recent years, and it is expected that consolidation will continue.

AMI forecasts that demand overall for SUPs will reach 113 billion units by 2021, a CAGR 2016–21 of almost 6%, but growth in some segments will be well above the average. “There are still technology gaps to meet complex customer demands particularly in high-performance applications to balance costs and technical requirements, which will provide opportunities for innovative and well organized companies” says Babits.