Super Sized

- Published: January 01, 2007, By By Heidi Kamp RISI

Corrugated Boxes

The retail landscape in the US changed dramatically in the past decade with nontraditional food stores claiming an increasing share of at-home food purchases. Nontraditional food stores include mass merchandisers, dollar stores, warehouse club stores, and super centers.

Warehouse club stores are membership retail/wholesale hybrids like Costco and Sam’s Club (a division of Wal-Mart). Super centers are food-drug combination stores and mass merchandisers under a single roof like Wal-Mart super centers and Super Target.

Most super center sales are attributed to Wal-Mart, with many news sources placing Wal-Mart’s share of total US at-home food purchases at approximately 17%. Indeed, the rise of Wal-Mart’s super centers is very recent, with its annual reports showing it owned six super centers in 1990, 147 in 1995, 721 in 2000, and an estimated 1,980 in 2006.

Club stores actually have been around a little longer; both Sam’s Club and Costco started business in the early 1980s. The early 1990s are when club stores experienced much of their growth, as the number of total Sam’s Club stores in the US was 123 in 1990, 426 in 1995, 462 in 2000, and an estimated 567 in 2006. This also indicates that after slower growth in Sam’s Club openings in the late 1990s, new warehouse club store openings are accelerating once again in the 2000s.

The rise of super center and warehouse club stores impacts the corrugated box business significantly and is offering many opportunities for potential growth as well as the possibility of decreased demand in the future. Wal-Mart has had a significant influence on suppliers due to its sizable rise in market share. Additionally, there are requests essentially unique to warehouse club stores and super centers regarding how products are packaged and shipped in corrugated boxes.

Display-Ready Cases

Since both super centers and warehouse club stores win customers by placing their emphasis on marked-down prices (rather than on service), a request they make to corrugated box converters is for display-ready cases. These boxes usually involve ripping off the top (sometimes the top will be perforated to facilitate this) and placing them directly on the shelf (in a super center) or keeping them on the pallet (in a club store). This allows the store to save on labor because individual products will not be unloaded from the box.

The move toward display-ready boxes is important to the outlook for corrugated box shipments because display-ready boxes tend to use more corrugated material per product. While suppliers prefer to pack a product as compactly as possible, club stores prefer less dense packaging so it is easier for the customer to take a product out of the display box and so the display looks nicer overall. Less densely packed products translate to the increasing ratio of corrugated box to product. Furthermore, the rise of warehouse club stores feeds the increased importance of secondary packaging in marketing a product. Since products often are unloaded straight from the delivery truck to the sales floor and sold in a pallet display—and often there is no sales help on the floor—display-ready corrugated boxes with attractive and colorful printing are becoming increasingly popular. Advancements in printing on corrugated certainly are helping this trend along.

Case-Ready Meat

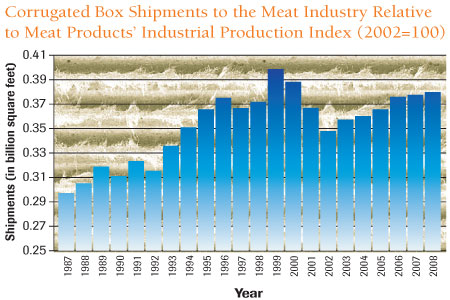

One example of how preferences for display-ready, convenient packaging affects the demand for corrugated boxes can be found in the meat industry. Growth in corrugated box shipments to the meat industry has outpaced growth in industrial output slightly during 2002–2006e, growing 2.9% annually. Shipment growth was strong, particularly during the 2003–2006e period, nearly reaching 4%/yr. Since the ratio of corrugated box shipments to industrial production has been increasing in the past four years (see chart below), it is likely either corrugated boxes are gaining market share or more corrugated material is being used per item shipped. Industry reports indicate meat packers’ demand for strength in their boxes has been increasing in recent years, supporting the theory that more material is being used per item shipped. However, this is only part of the story.

Demand for “case-ready” secondary packaging for meat has been increasing dramatically in recent years. Case-ready meat is cut and packaged outside of the store and shipped in containers that are display ready. As more discount stores emerge, stores are finding it more costly to have their own butcher on site, and club stores prefer meat to be packaged in ready-to-go cases.

The Fibre Box Assn. and the American Forest & Paper Assn. joined in late 2001 to form the Corrugated Packaging Alliance (CPA) to address the rising market share of returnable plastic crates (RPC) in the produce market. RPC manufacturers also had their eyes on the meat market because they perceived an opportunity to gain market share with the rise of case-ready meat. In response, the CPA released voluntary guidelines for two corrugated box “footprints” for case-ready meat. In 2005 the CPA began to increase the marketing muscle it was putting behind this effort.

An additional factor contributing to a heavier use of corrugated in the meat industry is consumer preference. More companies are recognizing consumers’ interest in convenience and dislike for handling meat, and they are responding by developing single-serving packages. Inevitably, whatever substrate is used to ship these, the ratio of secondary packaging to product will be higher since the product will be packaged less densely.

The ratio of corrugated shipments to industrial production is expected to continue growing in the coming years but at a more modest rate than witnessed during 2003–2006e. Growth in corrugated shipments still is expected to slightly outpace growth in industrial production at roughly the same margin. RISI forecasts an average annual growth rate in corrugated shipments to the meat industry of approximately 2.4% during the next few years.

In the future the retail landscape will help determine what industries are winners and what industries are losers for corrugated box converters.

Trends in Corrugated

RISI has published a new multi-client study, US Corrugated Box End-Use Markets: Forecast & Analysis through 2011, that covers all 28 corrugated box end-use markets and discusses many important factors that will affect each industry specifically as well as big picture trends.

For more information, contact RISI at risiinfol.com.

Heidi Kamp has been an economist with RISI, an information provider for the global forest products industry, since July 2005. Her focus is on the end-use markets for paperboard. She holds a Master of Science degree in economics from Caltech and a Bachelor of Science degree in economics as well as a Bachelor of Science mathematics degree from the Univ. of Minnesota. Contact Kamp at 781/734-8973; This email address is being protected from spambots. You need JavaScript enabled to view it..